how to calculate sales tax in oklahoma

This marginal tax rate means that. Enter an amount into the calculator above to find out how what kind of.

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

The Oklahoma OK state sales tax rate is currently 45.

. Your average tax rate is 1198 and your marginal tax rate is 22. However there are additional local sales tax rates in both the counties and major cities of Oklahoma. The Oklahoma state sales tax rate is 45.

As a business owner selling taxable goods or services. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. The calculator will show you the total sales tax amount as well as the.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. 325 of taxable value which decreases by 35 annually. 125 sales tax and 325 excise tax for a total 45 tax rate.

087 average effective rate. How is sales tax calculated in Oklahoma. Oklahoma charges two taxes for the purchase of new motor vehicles.

Find your Oklahoma combined. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. Sales Tax Chart For Oklahoma County Oklahoma.

Easily Download Print Forms From. Minus Tax Amount 000. Plus Tax Amount 000.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. The base state sales tax rate in Oklahoma is 45. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is.

This takes into account the rates on the state level county level city level and special level. 2022 Oklahoma state sales tax. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers.

The base sales tax rate in Oklahoma is 45. H ow 2021 Sales taxes are calculated for zip code 73170. The most populous county.

Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale. On-Time Sales Tax Filing Guaranteed. Oklahoma Sales Tax Rates.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Get Your First Month Free. Ad Seamless POS System Integration.

Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Just enter the five-digit zip. In Oklahoma this will always be 325.

To know what the current sales tax rate applies in your state ie. For more accurate rates use the sales tax calculator. Before Tax Amount 000.

Depending on local municipalities the total tax rate can be as high as 115. 19 cents per gallon of regular gasoline and. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 857 in Oklahoma County. Ad calculate sales tax by state. Blank Forms PDF Forms Printable Forms Fillable Forms.

325 of ½ the actual purchase pricecurrent value. We would like to show you a description here but the site wont allow us. You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code.

Exact tax amount may vary for different items. Calculate sales tax by state. The average cumulative sales tax rate in the state of Oklahoma is 771.

The 73170 Oklahoma City Oklahoma general sales tax rate is 875. Oklahoma State Tax Quick Facts. Multiply the vehicle price after trade-ins and incentives.

Used vehicles are taxed a flat fee of 20 on. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Business Guide To Sales Tax In Oklahoma

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Register For A Sales Tax Permit In Oklahoma Taxvalet

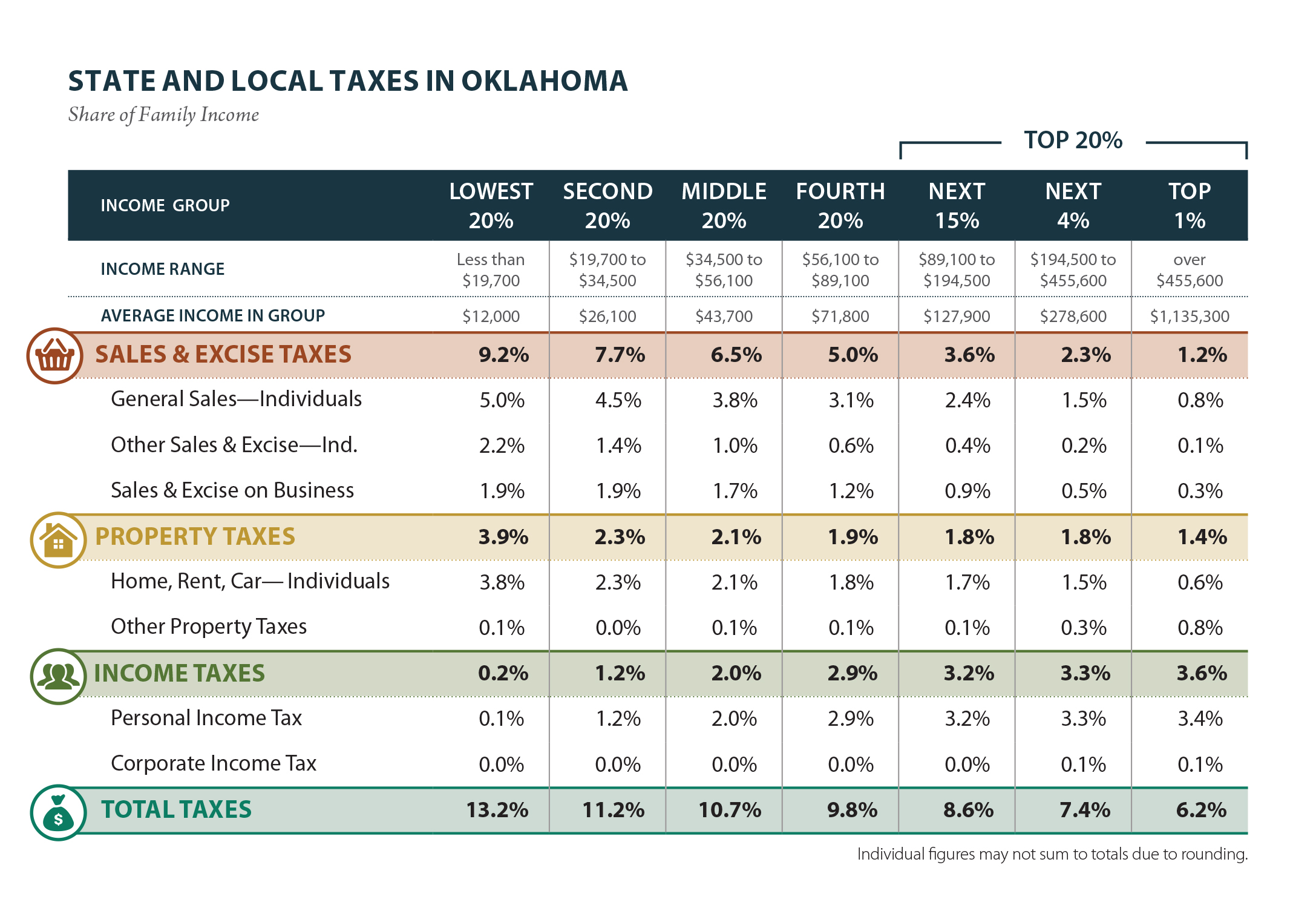

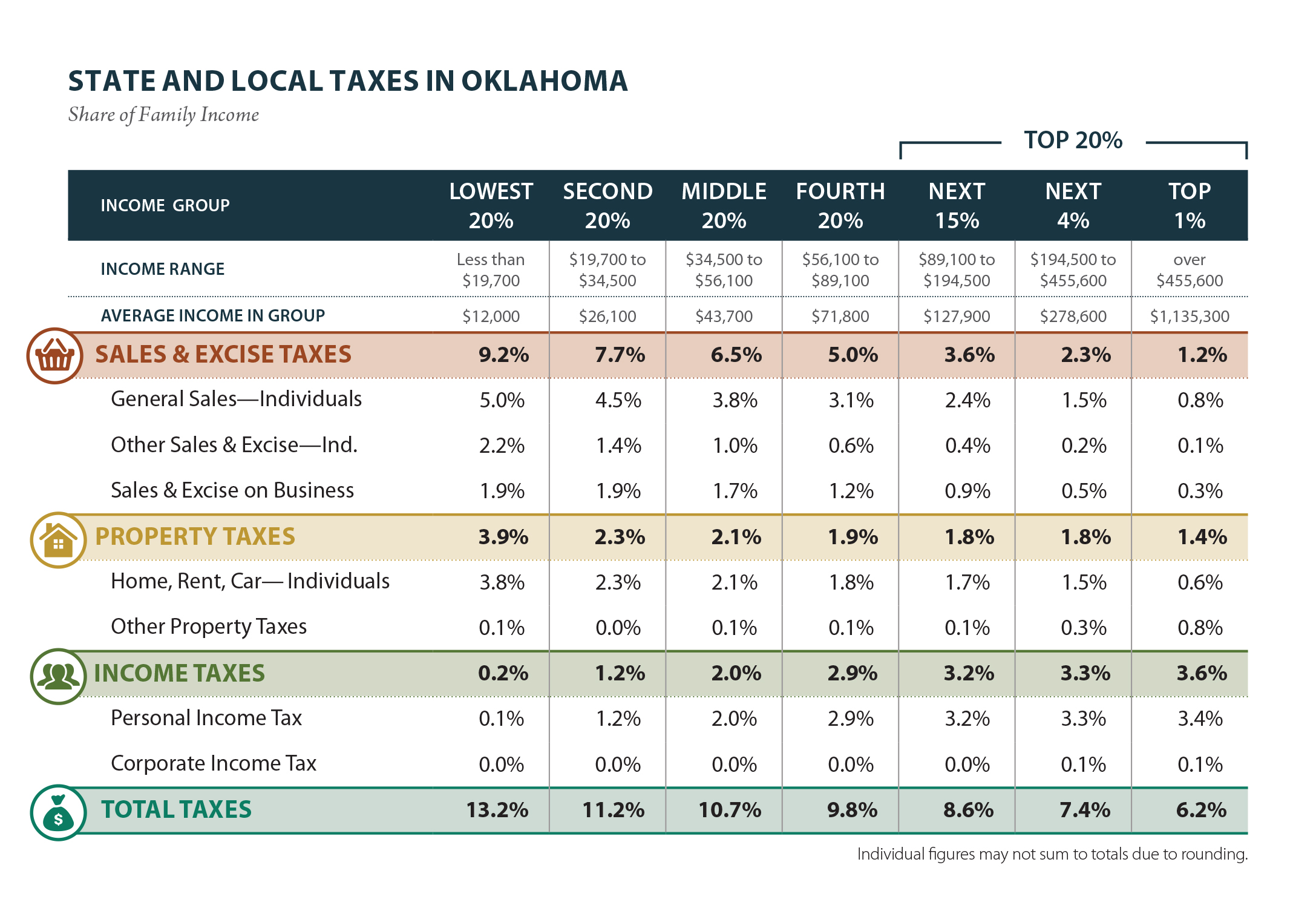

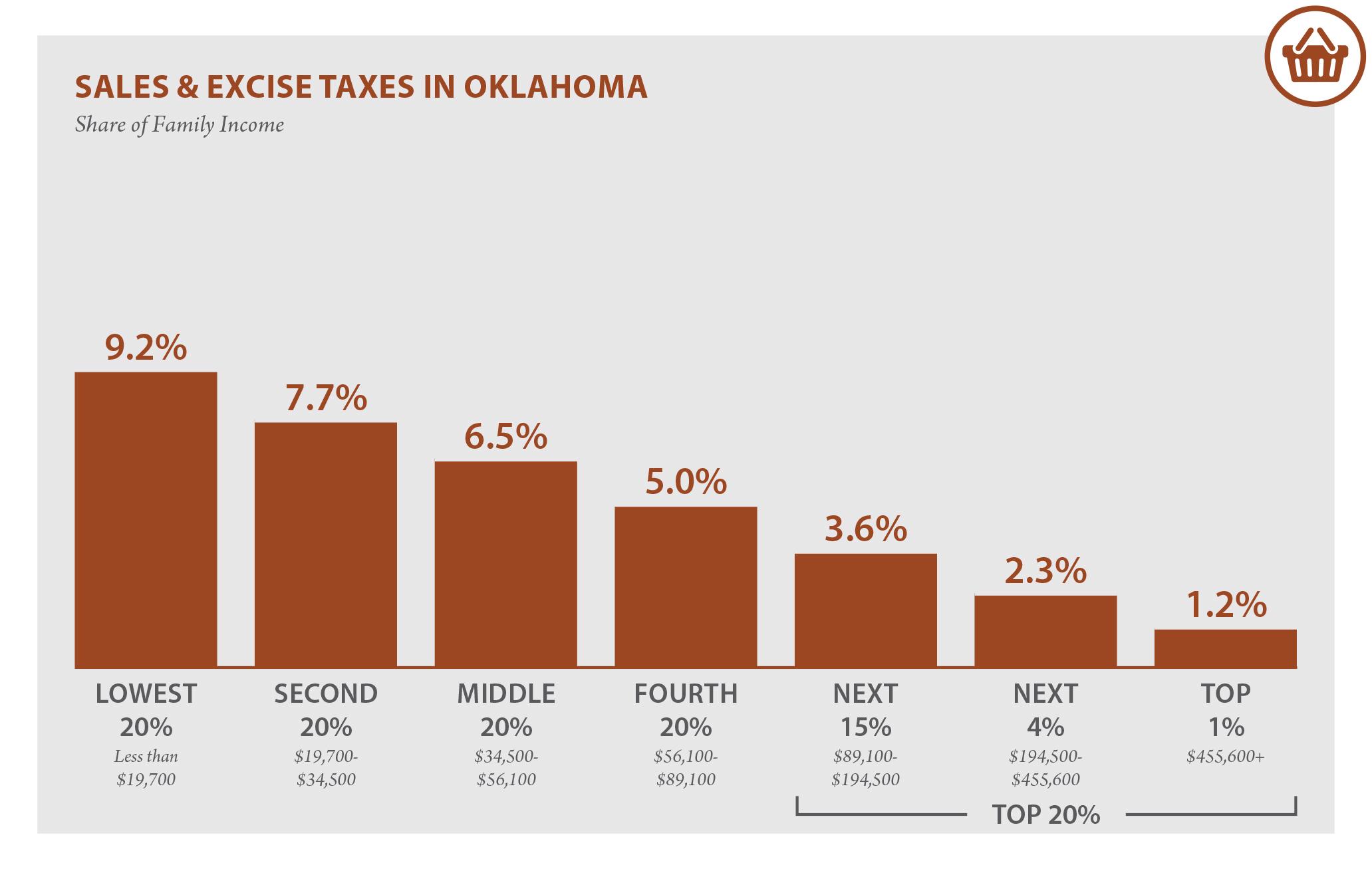

Oklahoma Who Pays 6th Edition Itep

Oklahoma Sales Tax Handbook 2022

Beginner S Guide To Dropshipping Sales Tax Blog Printful

What Is Sales Tax Nexus Learn All About Nexus

Sales Tax By State Is Saas Taxable Taxjar

Oklahoma Who Pays 6th Edition Itep

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Charge Your Customers The Correct Sales Tax Rates